Who Is Going To Make Money In AI?

Who Is Going To Make Money In AI?: We are in the midst of a gold rush in AI. But who will reap the economic benefits? The mass of startups who are all gold panning? The corporates who have massive gold mining operations? The technology giants who are supplying the picks and shovels? And which nations have the richest seams of gold?

Welcome to the AI gold rush!

We are currently experiencing another gold rush in AI. Billions are being invested in AI startups across every imaginable industry and business function. Google, Amazon, Microsoft and IBM are in a heavyweight fight investing over $20 billion in AI in 2016. Corporates are scrambling to ensure they realise the productivity benefits of AI ahead of their competitors while looking over their shoulders at the startups. China is putting its considerable weight behind AI and the European Union is talking about a $22 billion AI investment as it fears losing ground to China and the US.

AI is everywhere. From the 3.5 billion daily searches on Google to the new Apple iPhone X that uses facial recognition to Amazon Alexa that cutely answers our questions. Media headlines tout the stories of how AI is helping doctors diagnose diseases, banks better assess customer loan risks, farmers predict crop yields, marketers target and retain customers, and manufacturers improve quality control. And there are think tanks dedicated to studying the physical, cyber and political risks of AI.

So who will make the money in AI?

AI and machine learning will become ubiquitous and woven into the fabric of society. But as with any gold rush the question is who will find gold? Will it just be the brave, the few and the large? Or can the snappy upstarts grab their nuggets? Will those providing the picks and shovel make most of the money? And who will hit pay dirt?

So where is the value being created with AI?

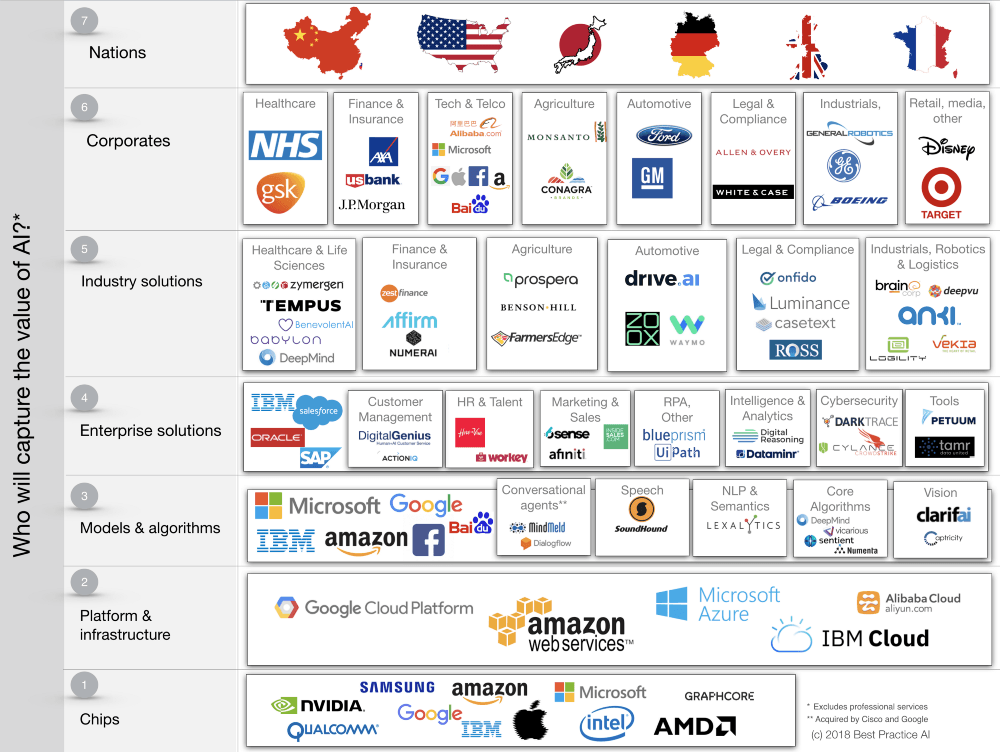

As I started thinking about who was going to make money in AI I ended up with seven questions. Who will make money across the (1) chip makers, (2) platform and infrastructure providers, (3) enabling models and algorithm providers, (4) enterprise solution providers, (5) industry vertical solution providers, (6) corporate users of AI and (7) nations? While there are many ways to skin the cat of the AI landscape, hopefully below provides a useful explanatory framework — a value chain of sorts. The companies noted are representative of larger players in each category but in no way is this list intended to be comprehensive or predictive.

This is an example of an AI value chain. The companies noted are representative of larger players in each category but in no way is this list intended to be comprehensive or predictive. © Best Practice AI Ltd.

- Who’s got the best AI chips and hardware?

Even though the price of computational power has fallen exponentially, demand is rising even faster. AI and machine learning with its massive datasets and its trillions of vector and matrix calculations has a ferocious and insatiable appetite. Bring on the chips.

NVIDIA’s stock is up 1500% in the past two years benefiting from the fact that their graphical processing unit (GPU) chips that were historically used to render beautiful high speed flowing games graphics were perfect for machine learning. Google recently launched its second generation of Tensor Processing Units (TPUs). And Microsoft is building its own Brainwave AI machine learning chips. At the same time startups such as Graphcore, who has raised over $110M, is looking to enter the market. Incumbents chip providers such as IBM, Intel, Qualcomm and AMD are not standing still. Even Facebook is rumoured to be building a team to design its own AI chips. And the Chinese are emerging as serious chip players with Cambricon Technology announcing the first cloud AI chip this past week.

Who made the money? Levi Strauss and Samuel Brannan didn’t mine for gold themselves but instead made a fortune selling supplies to miners — wheelbarrows, tents, jeans, picks and shovels, etc.

What is clear is that the cost of designing and manufacturing chips then sustaining a position as a global chip leader is very high. It requires extremely deep pockets and a world class team of silicon and software engineers. This means that there will be very few new winners. Just like the gold rush days those that provide the cheapest and most widely used picks and shovels will make a lot of money.

- Who’s got the best infrastructure and platform clouds for AI?

The AI race is now also taking place in the cloud. Amazon realised early that startups would much rather rent computers and software than buy it. And so it launched Amazon Web Services (AWS) in 2006. Today AI is demanding so much compute power that companies are increasingly turning to the cloud to rent hardware through Infrastructure as a Service (IaaS) and Platform as a Service (PaaS) offerings.

Amazon is the leader in cloud services but hot on their tales are Microsoft, IBM, Google and Alibaba.

The fight is on among the tech giants. Microsoft is offering their hybrid public and private Azure cloud service that allegedly has over one million computers. And in the past few weeks they announced that their Brainwave hardware solutions dramatically accelerate machine learning with their own Bing search engine performance improving by a factor of ten. Google is rushing to play catchup with its own GoogleCloud offering. And we are seeing the Chinese Alibaba starting to take global share.

Large cloud players are racing to ensure they are positioned for the massive demand that will be driven by AI.

Amazon — Microsoft — Google and IBM are going to continue to duke this one out. And watch out for the massively scaled cloud players from China. The big picks and shovels guys will win again.

- Who’s got the best enabling algorithms?

Today Google is the world’s largest AI company attracting the best AI minds, spending small country size GDP budgets on R&D, and sitting on the best datasets gleamed from the billions of users of their services. AI is powering Google’s search, autonomous vehicles, speech recognition, intelligent reasoning, massive search and even its own work on drug discovery and disease diangosis.

And the incredible AI machine learning software and algorithms that are powering all of Google’s AI activity — TensorFlow — is now being given away for free. Yes for free! TensorFlow is now an open source software project available to the world. And why are they doing this? As Jeff Dean, head of Google Brain, recently said there are 20 million organisations in the world that could benefit from machine learning today. If millions of companies use this best in class free AI software then they are likely to need lots of computing power. And who is better served to offer that? Well Google Cloud is of course optimised for TensorFlow and related AI services. And once you become reliant on their software and their cloud you become a very sticky customer for many years to come. No wonder it is a brutal race for global AI algorithm dominance with Amazon — Microsoft — IBM also offering their own cheap or free AI software services.

We are also seeing a fight for not only machine learning algorithms but cognitive algorithms that offer services for conversational agents and bots, speech, natural language processing (NLP) and semantics, vision, and enhanced core algorithms. One startup in this increasingly contested space is Clarifai who provides advanced image recognition systems for businesses to detect near-duplicates and visual searches. It has raised nearly $40M over the past three years. The market for vision related algorithms and services is estimated to be a cumulative $8 billion in revenue between 2016 and 2025.

The race is on for the deep learning and cognitive algorithms that will enable and power applied AI solutions. The giants are not standing still. IBM, for example, is offering its Watson cognitive products and services. They have twenty or so APIs for chatbots, vision, speech, language, knowledge management and empathy that can be simply be plugged into corporate software to create AI enabled applications. Cognitive APIs are everywhere. KDnuggets lists here over 50 of the top cognitive services from the giants and startups. These services are being put into the cloud as AI as a Service (AIaaS) to make them more accessible. Just recently Microsoft’s CEO Satya Nadella claimed that a million developers are using their AI APIs, services and tools for building AI-powered apps and nearly 300,000 developers are using their tools for chatbots. I wouldn’t want to be a startup competing with these Goliaths.

The winners in this space are likely to favour the heavyweights again. They can hire the best research and engineering talent, spend the most money, and have access to the largest datasets. To flourish startups are going to have to be really well funded, supported by leading researchers with a whole battery of IP patents and published papers, deep domain expertise, and have access to quality datasets. And they should have excellent navigational skills to sail ahead of the giants or sail different races. There will many startup casualties, but those that can scale will find themselves as global enterprises or quickly acquired by the heavyweights. And even if a startup has not found a path to commercialisation, then they could become acquihires (companies bought for their talent) if they are working on enabling AI algorithms with a strong research oriented team. We saw this in 2014 when DeepMind, a two year old London based company that developed unique reinforcement machine learning algorithms, was acquired by Google for $400M.

- Who has the best enterprise solutions?

Enterprise software has been dominated by giants such as Salesforce, IBM, Oracle and SAP. They all recognise that AI is a tool that needs to be integrated into their enterprise offerings. But many startups are rushing to become the next generation of enterprise services filling in gaps where the incumbents don’t currently tread or even attempting to disrupt them.

We analysed over two hundred use cases in the enterprise space ranging from customer management to marketing to cybersecurity to intelligence to HR to the hot area of Cognitive Robotic Process Automation (RPA). The enterprise field is much more open than previous spaces with a veritable medley of startups providing point solutions for these use cases. Today there are over 200 AI powered companies just in the recruitment space, many of them AI startups. Cybersecurity leader DarkTrace and RPA leader UiPathhave war chests in the $100 millions. The incumbents also want to make sure their ecosystems stay on the forefront and are investing in startups that enhance their offering. Salesforce has invested in Digital Genius a customer management solution and similarly Unbable that offers enterprise translation services. Incumbents also often have more pressing problems. SAP, for example, is rushing to play catchup in offering a cloud solution, let alone catchup in AI. We are also seeing tools providers trying to simplify the tasks required to create, deploy and manage AI services in the enterprise. Machine learning training, for example, is a messy business where 80% of time can be spent on data wrangling. And an inordinate amount of time is spent on testing and tuning of what is called hyperparameters. Petuum, a tools provider based in Pittsburgh in the US, has raised over $100M to help accelerate and optimise the deployment of machine learning models.

Enterprise AI solutions will drive improved customer service and productivity. Many of these enterprise startup providers can have a healthy future if they quickly demonstrate that they are solving and scaling solutions to meet real world enterprise needs. But as always happens in software gold rushes there will be a handful of winners in each category. And for those AI enterprise category winners they are likely to be snapped up, along with the best in-class tool providers, by the giants if they look too threatening.

- Who’s got the best vertical solutions?

AI is driving a race for the best vertical industry solutions. There are a wealth of new AI powered startups providing solutions to corporate use cases in the healthcare, financial services, agriculture, automative, legal and industrial sectors. And many startups are taking the ambitious path to disrupt the incumbent corporate players by offering a service directly to the same customers.

New industry AI solutions will either power or disrupt organisations.

It is clear that many startups are providing valuable point solutions and can succeed if they have access to (1) large and proprietary data training sets, (2) domain knowledge that gives them deep insights into the opportunities within a sector, (3) a deep pool of talent around applied AI and (4) deep pockets of capital to fund rapid growth. Those startups that are doing well generally speak the corporate commercial language of customers, business efficiency and ROI in the form of well developed go-to-market plans.

For example, ZestFinance has raised nearly $300M to help improve credit decision making that will provide fair and transparent credit to everyone. They claim they have the world’s best data scientists. But they would, wouldn’t they? For those startups that are looking to disrupt existing corporate players they need really deep pockets. For example, Affirm, that offers loans to consumers at the point of sale, has raised over $700M. These companies quickly need to create a defensible moat to ensure they remain competitive. This can come from data network effects where more data begets better AI based services and products that gets more revenue and customers that gets more data. And so the flywheel effect continues.

- Which corporates will capture the value of AI?

And while corporates might look to new vendors in their industry for AI solutions that could enhance their top and bottom line, they are not going to sit back and let upstarts muscle in on their customers. And they are not going to sit still and let their corporate competitors gain the first advantage through AI. There is currently a massive race for corporate innovation. Large companies have their own venture groups investing in startups, running accelerators and building their own startups to ensure that they are leaders in AI driven innovation.

Corporates are well positioned to capture value from AI in the form of enhanced customer service, increase productivity and improved products and services.

Large corporates are in a strong position against the startups and smaller companies due to their data assets. Data is the fuel for AI and machine learning. Who is better placed to take advantage of AI than the insurance company that has reams of historic data on underwriting claims? The financial services company that knows everything about consumer financial product buying behaviour? Or the search company that sees more user searches for information than any other?

Corporates large and small are well positioned to extract value from AI. In fact Gartner research predicts AI-derived business value is projected to reach up to $3.9 trillion by 2022. There are hundreds if not thousands of valuable use cases that AI can addresses across organisations. Corporates can improve their customer experience, save costs, lower prices, drive revenues and sell better products and services powered by AI. AI will help the big get bigger often at the expense of smaller companies. But they will need to demonstrate strong visionary leadership, an ability to execute, and a tolerance for not always getting technology enabled projects right on the first try.

- Which countries will see the most benefits from AI?

Countries are also also in a battle for AI supremacy. China has not been shy about its call to arms around AI. It is investing massively in growing technical talent and developing startups. Its more lax regulatory environment, especially in data privacy, helps China lead in AI sectors such as security and facial recognition. Just recently there was an example of Chinese police picking out one most wanted face in a crowd of 50,000 at a music concert. And SenseTime Group Ltd, that analyses faces and images on a massive scale, reported it raised $600M becoming the most valuable global AI startup. The Chinese point out that their mobile market is 3x the size of the US and there are 50x more mobile payments taking place — this is a massive data advantage. The European focus on data privacy regulation could put them at a disadvantage in certain areas of AI even if the Union is talking about a $22B investment in AI.

Will this be the sovereign winners in AI? China? US? Japan? Germany? UK? France?

The UK, Germany, France and Japan have all made recent announcements about their nation state AI strategies. For example, President Macron said the French government will spend $1.85 billion over the next five years to support the AI ecosystem including the creation of large public datasets. Companies such as Google’s DeepMind and Samsung have committed to open new Paris labs and Fujitsu is expanding its Paris research centre. The British just announced a $1.4 billion push into AI including funding of 1000 AI PhDs. But while nations are investing in AI talent and the ecosystem, the question is who will really capture the value. Will France and the UK simply be subsidising PhDs who will be hired by Google? And while payroll and income taxes will be healthy on those six figure machine learning salaries, the bulk of the economic value created could be with this American company, its shareholders, and the smiling American Treasury.

AI will increase productivity and wealth in companies and countries. But how will that wealth be distributed when the headlines suggest that 30 to 40% of our jobs will be taken by the machines? Economists can point to lessons from hundreds of years of increasing technology automation. Will there be net job creation or net job loss? The public debate often cites Geoffrey Hinton, the godfather of machine learning, who suggested radiologists will lose their jobs by the dozen as machines diagnose diseases from medical images. But then we can look to the Chinese who are using AI to assist radiologists in managing the overwhelming demand to review 1.4 billion CT scans annually for lung cancer. The result is not job losses but an expanded market with more efficient and accurate diagnosis. However there is likely to be a period of upheaval when much of the value will go to those few companies and countries that control AI technology and data. And lower skilled countries whose wealth depends on jobs that are targets of AI automation will likely suffer. AI will favour the large and the technologically skilled.

So what does this all mean?

In examining the landscape of AI it has became clear that we are now entering a truly golden era for AI. And there are few key themes appearing as to where the economic value will migrate:

- The global technology giantsre the picks and shovels of this gold rush — powering AI for whoever whats to rush in. Google-Amazon-Microsoft and IBM are in arms race for leadership in AI. They are slugging it out to offer the best chips, cloud and AI algorithms and services. And coming up behind are the Chinese tech giants Alibaba and Baidu. Few startups are going to outspend, outsmart or offer low prices that Microsoft on what is increasingly commodity cloud computing or build a better AI chip than Google’s Tensor Processing Unit or build better object recognition cognitive algorithms than Amazon.

- AI startups are flocking to offer cognitive algorithms, enterprise solutions and deep industry vertical solutions. To prosper startups will need to have access to unique data sets, deep domain knowledge, deep pockets and an ability to attract and retain the increasingly in-demand AI talent. This is not a case of an app in a garage will change the world. AI startup winners will be those that solve valuable real-world problems, scale their go-to-market quickly and build defensible Startups should focus on enterprise and industry solutions where there are many high value use cases to be tackled. However startup acquihires in the algorithmic space will be somewhat common, for at least the next few years, as the talent war continues. There will be many startup casualties along the way with a handful of winners in each category as is true in any gold rush. And those winners are likely to find themselves being offered tantalising cheques by the giants.

- Corporates are well positioned to extract substantial, some say in the trillionsof dollars, of value from AI. AI will increasingly drive an enhanced customer experience, help drive productivity and cost reduction through the assistance and automation major businesses processes, and improve the competitiveness of product and service offerings. Most value will be obtained from those companies who have scale — the best and biggest datasets, the most customers and the largest distribution. The bigger will likely get bigger. But this will only happen if the corporates demonstrate strong leadership and execute with a nimbleness that has not typically been their calling card. The corporates that are leading in AI execution are once again the tech giants in Google, Facebook, Apple and Amazon who are offering AI powered products and services that are reaching global audiences in the billions. And corporates in industries ranging from retail to healthcare to media are running scared as the tech giants use AI to enter and disrupt new sectors.

- Nation states are also in an AI race. China has not been shy about its intent to be a world leader in AI by 2030. It believes that it has structural advantages. While many European countries are touting their government backed commitments to AI the risk is that they are simply going to subsidise talent for the global AI giants and accelerate the wealth of other sovereign nations. And will strong data privacy regulations hurt European countries innovate in AI? The wealth from AI is likely to go to those countries and companies who control and leverage the leading AI technology and data — think US and China. And those without will likely be challenged as automation encroaches on increasingly lower paid jobs.

In short it looks like the AI gold rush will favour the companies and countries with control and scale over the best AI tools and technology, the data, the best technical workers, the most customers and the strongest access to capital. Those with scale will capture the lion’s share of the economic value from AI. In some ways ‘plus ça change, plus c’est la même chose.’ But there will also be large golden nuggets that will be found by a few choice brave startups. But like any gold rush many startups will hit pay dirt. And many individuals and societies will likely feel like they have not seen the benefits of the gold rush.

This is the first part in a series of articles I intend to write on the topic of the economics of AI. I welcome your feedback.

About the Author

Simon Greenman has over twenty years of leading digital transformations through technology, data science and AI. He is co-founder and partner in Best Practice AI, a London based AI executive advisory with a leading library of AI use cases and case studies.

Earlier in his career Simon was a co-founder of MapQuest.com, one of the first internet brands. He has over ten year as Chief Digital Officer leading transformations of media companies for private equity. He has also consulted or worked for HomeAdvisor Europe, AOL, Bowers & Wilkins, and Accenture.

Simon is highly active in the AI startup community. He is AI Entrepreneur in Resident at Seedcamp, Co-President of the Harvard Business School Alumni Angels of London, and an advisor and former venture partner at DN Capital.

He holds an MBA from the Harvard Business School and a BA in Computing & Artificial Intelligence from the University of Sussex.

The article is originally published on medium.com by Simon Greenman, Founder & Partner, Best Practice AI and is republished with the author’s permission.